Bitcoin's Trade War Rebound

April's data reveals Bitcoin breaking through fear-driven sentiment to emerge as a leading force in transforming asset markets

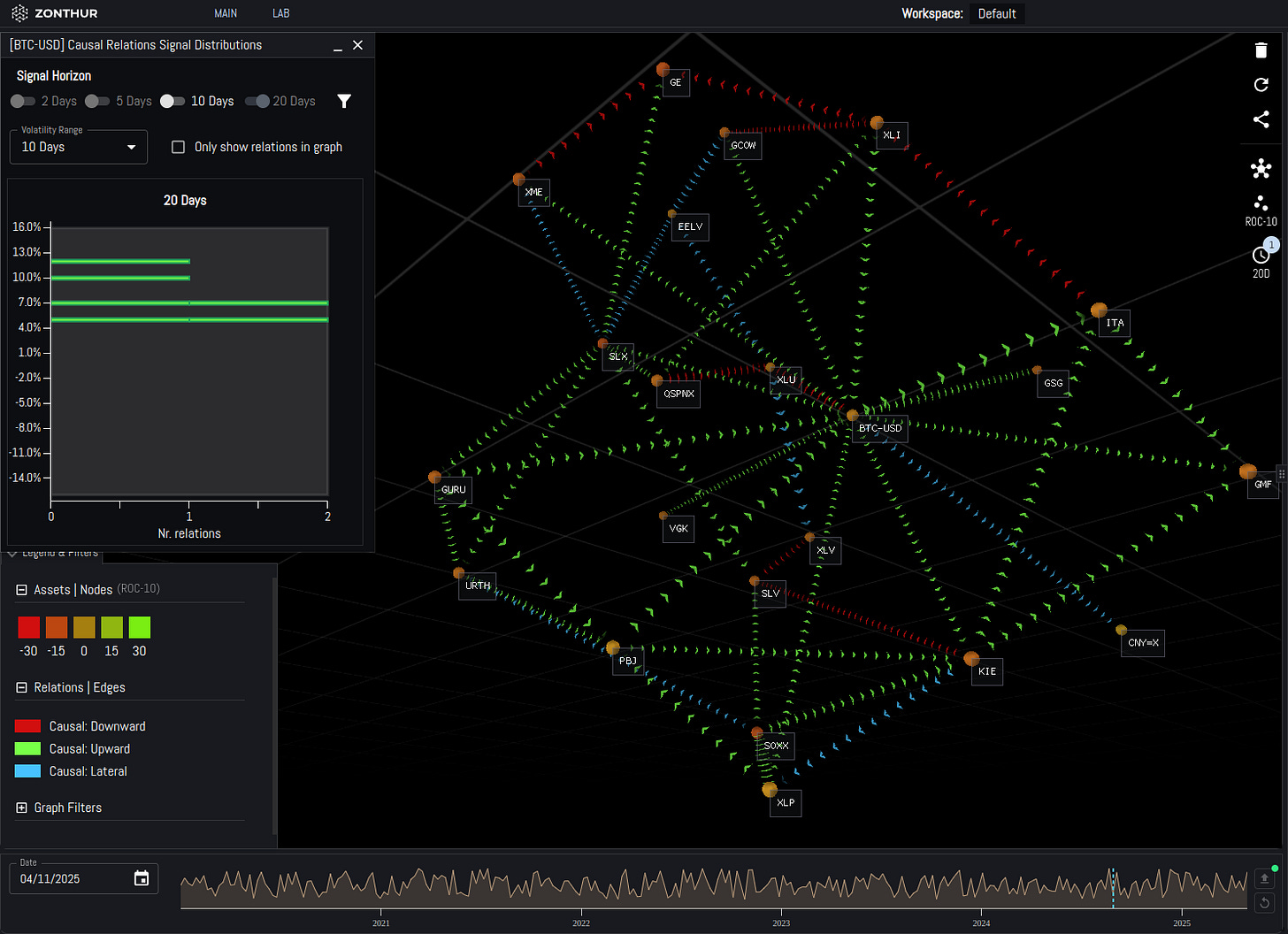

As Bitcoin’s price dipped on April 7, the Fear-Greed Index deepened into fear. By April 11, the University of Michigan Consumer Sentiment Index plunged to 50.8 - a near-historic low amid trade war concerns - further fueling market pessimism. Yet, Zonthur’s non-linear causal inference models consistently signaled a Bitcoin rebound throughout this period, driven by evolving causal relationships within a broader network of assets and sectors.

April 7: Decoding Volatility with Causal Clarity

Our quantitative framework revealed that Bitcoin’s price drop was a fleeting response to market-wide fear, as the ongoing price drivers signaled a >6% appreciation over the subsequent 20 days. Unlike opaque ML predictions, this methodology identifies specific causal signals driving asset behavior and offers transparency into their individual forecasts, performance, and networked effects.

On April 7, key price drivers included:

· Managed Futures Strategies

· US Mid-Caps, Industrials, and Consumer Staples

The consensus of these signals was for a price appreciation in a 20-days horizon.

April 11: Evolving Signals in a Fear-Driven Market

By April 11, consumer sentiment reached a historically low point and the Fear-Greed Index deepened into fear. Our models reaffirmed Bitcoin’s rebound potential with mostly the same drivers despite the market volatility and uncertainty. Some relations weakened and some fragmented but most remained resilient throughout this period. An upward price movement was still the general consensus among our signals.

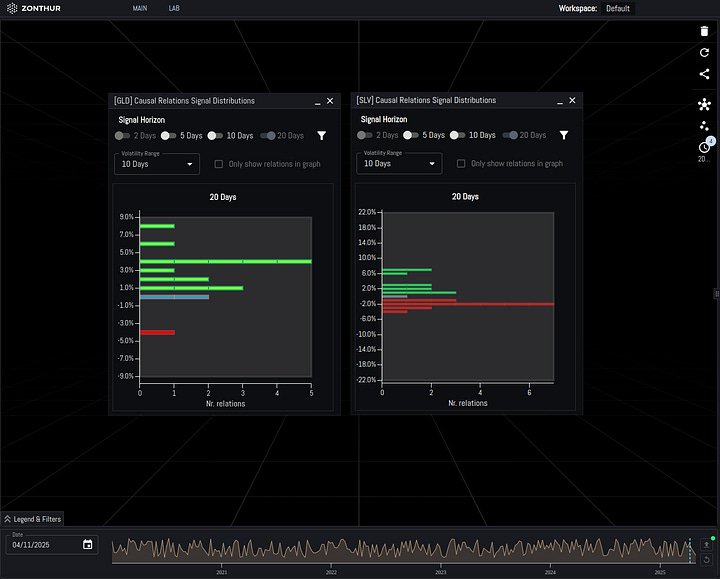

Silver’s causal forward-looking signals, for instance, grew ambiguous between April 7th and 11th but Bitcoin and Gold retained strong directional clarity. Zonthur’s network analytics allowed us to observe emergent effects - such as how asset clusters signaled Bitcoin’s rally - while tracking each signal’s historical performance to validate its reliability.

Why This Matters for Asset Managers

Zonthur’s approach stands apart by offering visibility into the non-linear causal relationships driving markets. For portfolio managers, this means not just seeing a forecast but understanding why it holds or not, through transparent signal analysis and network effects.

By mapping how assets' price movement - like managed futures funds and financials - were signaling an upward movement in Bitcoin's price, Zonthur equips teams to anticipate reversals, assess signal reliability, and adjust strategies with precision. During volatile markets, this clarity is a game-changer.

Fear and Greed source: https://coinstats.app/fear-and-greed/

Disclaimer: The information provided in this content is for general informational purposes only and does not constitute investment, financial, legal, tax, or other professional advice. It should not be relied upon as such. Always consult with a qualified professional or advisor before making any investment or financial decisions.