Ethereum: Risk and Reward

Tactical execution considerations over a bearish Ethereum signal; how to balance between risk and volatility.

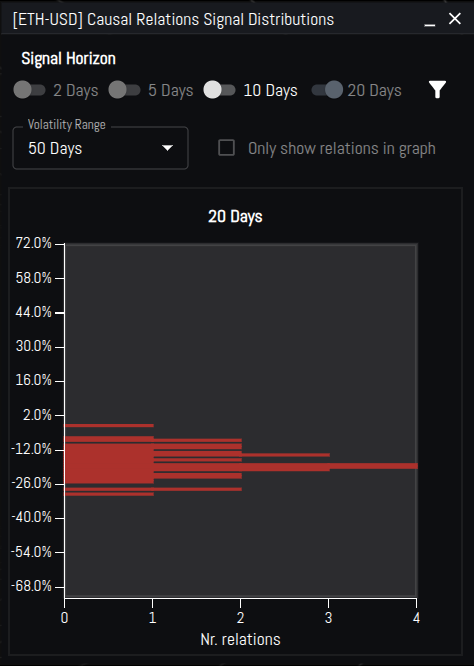

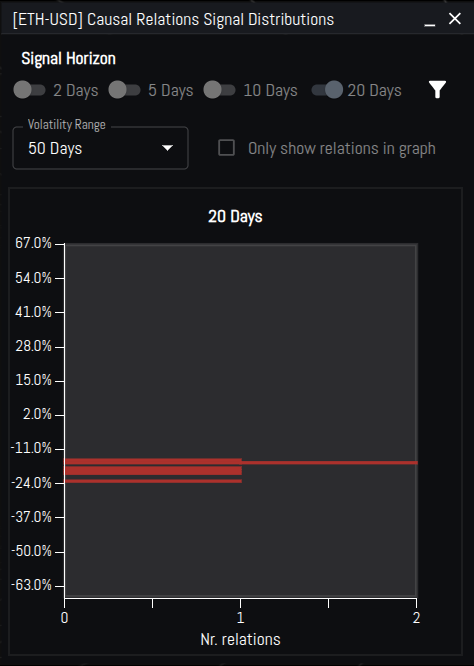

On June 3, 2025, our causal network models issued a bearish signal for Ethereum (ETH), forecasting a minimum 5% price correction from $2,630, with a target drawdown of 15%. This analysis evaluates the model’s performance over the subsequent 20 days and quantifies the risk-adjusted returns available to institutional traders.

By June 22, ETH reached a low of $2,128, reflecting a 19.1% drawdown from the entry point, surpassing the target forecast.

The trade unfolded with actionable opportunities for alpha capture. By Day 3, ETH traded at $2,433, offering a 7.5% return for short positions or put option holders. Over the 20-day period, ETH remained within a 4% decline range for 13 days, punctuated by a transient rally from June 10-12 (peak price $2,877, +9.4% from entry). This volatility challenged high-leverage shorts but validated the model’s persistent bearish signal, as downside pressure resumed. By Day 19, portfolios holding the full position captured a 19.1% return.

Strategic Trade Implementation and Profit Optimization

The choice of trade implementation in executing a bearish Ethereum signal, such as the above described, demands a nuanced approach to risk management and exit strategies. A naked short position (while capital-efficient) carried unbounded risk, particularly during transient price spikes like those observed from June 10-12. Such volatility could have strained margin requirements or triggered premature unwinds, especially for leveraged portfolios.

Put options provided a controlled risk profile, capping losses at the premium while preserving convex exposure to downside moves. However, options introduce complexities around strike selection, implied volatility, and theta decay. During the 13-day period when ETH traded within a 4% decline range, long-dated puts or spreads could mitigate time decay relative to short-dated contracts, though at higher upfront costs.

Portfolio managers must weigh these dynamics against liquidity needs and VaR constraints to align with fund mandates.

Profit-taking decisions further underscore the importance of disciplined execution. The 7.5% decline to $2,433 by Day 3 presented a low-drawdown exit, enabling capital reallocation with minimal market risk - a prudent choice for funds prioritizing consistent alpha. Holding through to the 19% decline at $2,128, however, offered substantial returns for those employing robust risk controls, such as dynamic delta hedging or trailing stops.

These trade-offs hinge on balancing the statistical edge of the forecast against market beta exposure and opportunity costs, hence Zonthur's focus on the transparency of its forecasts and signal's ongoing performance to support managers in such critical decisions.

Disclaimer: The information provided in this content is for general informational purposes only and does not constitute investment, financial, legal, tax, or other professional advice. It should not be relied upon as such. Always consult with a qualified professional or advisor before making any investment or financial decisions.