From Trade Wars to Fragmentation

Analysis of trade wars escalation and current de-escalation through causal networks

In May 2025, a new chapter in U.S.-China trade wars - marked by de-escalation, post-election turbulence, and Federal Reserve rate stability - has reshaped market structures, fragmenting asset relationships and altering risk dynamics.

This analysis (March 24–May 14, 2025) traces two months of market evolution through five stages, showing how trade war escalation and resolution shaped today’s fragmented landscape. Key findings:

Decoupling of BND from UUP and ^TNX signals a shift in fixed-income dynamics amid trade war de-escalation.

Central role of EMB in driving crypto (BTC-USD, BITW) during trade wars reflects emerging markets’ broader market influence.

Growing macro sensitivity of crypto, tied to EMB’s causal role, underscores its evolution as a risk-on asset.

Let’s walk through the five stages of the analysis.

Stage 1: Pre-Trade War Tensions (March 24-28)

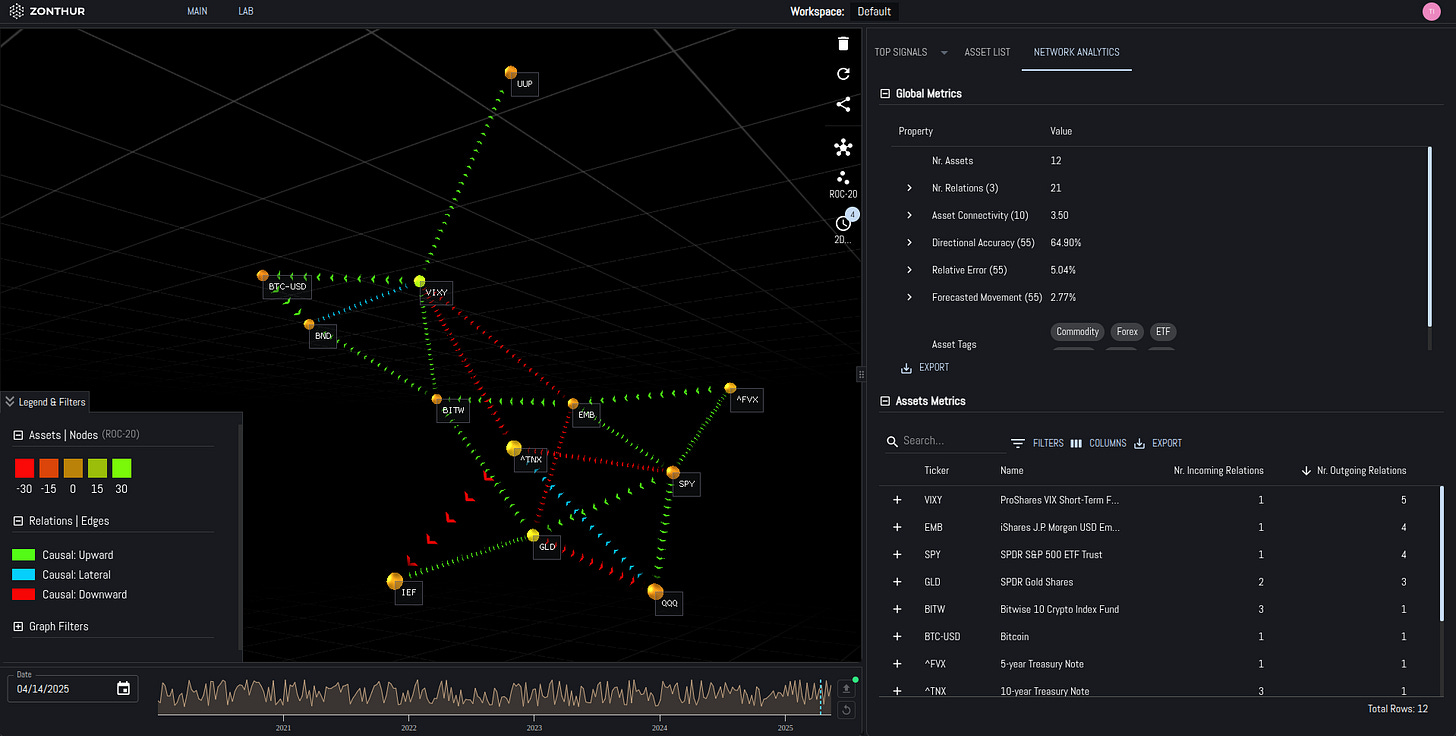

In late March, as rumors of a potential trade war surfaced, our causal network analysis showed a well-connected system, with an average connectivity of around 4.33 (i.e. number of assets connected to each asset, on average, in the current network; relevant to measure markets’ interconnectivity), directional accuracy of approximately 65.57%, and an average relative error of 3.36% (i.e. how good have the causal signals in the network been at forecasting price direction and how precise they were at estimating the price value, respectively).

Assets such as the Emerging Markets Bond ETF (EMB), Gold (GLD), VIX Short-Term Futures (VIXY), S&P 500 ETF (SPY), and 10-year Treasury Bonds were heavily influenced by others, with EMB’s sensitivity doubling to an in-degree of 8 by March 28 (i.e. how many assets were driving this asset’s price movement), signaling its exposure to global uncertainties. Meanwhile, 5-year Treasury Bonds, SPY, Nasdaq ETF (QQQ), Bitwise 10 Crypto Index (BITW), and Bitcoin (BTC-USD) acted as primary influencers, shaping market dynamics.

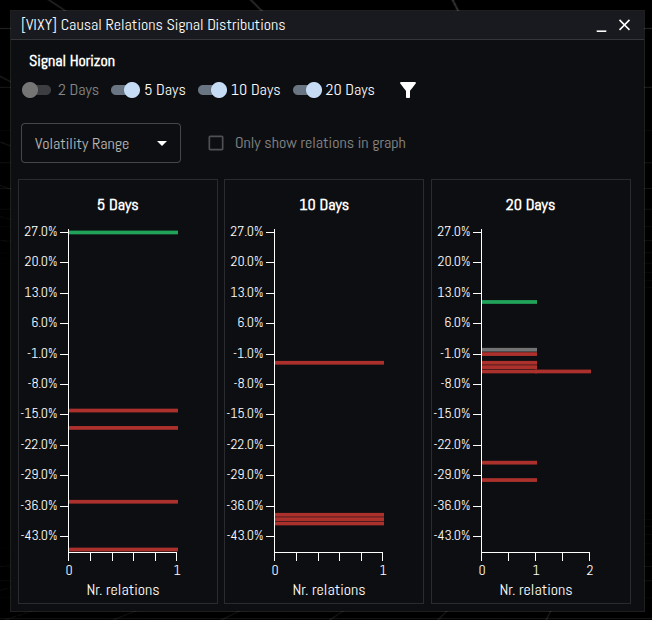

The rapid increase in EMB’s in-degree highlighted emerging markets’ vulnerability, making it a key asset to monitor. VIXY’s higher in-degree, paired with our signals of a significant 20-day increase, accurately predicted a rise in the VIX index, reflecting growing market fear.

For trading, long positions in VIXY or volatility-linked derivatives offered short-term opportunities, while Gold warranted closer analysis due to mixed 10- and 20-day outlooks.

On the risk side, EMB’s sensitivity called for closer monitoring of assets such as 5-year Treasuries which now have a bigger impact on emerging markets, represented as stronger causal relationships.

Stage 2: Trade War Escalation (March 31–April 11)

The U.S. announcement of significant tariffs on China on April 2 sent shockwaves through markets. Our network remained connected, with average connectivity between 3.83 and 5, but instability grew, with average relative error climbing to 4.6–5%, peaking at 5% on April 10.

EMB, GLD, VIXY, and 10-year Treasuries continued to be heavily influenced, with EMB’s in-degree steady at 5–6, while SPY, GLD, VIXY, 10-year Treasuries, and EMB itself emerged as key influencers of other assets in the network (i.e. higher out-degree).

The U.S. Dollar Index ETF (UUP) briefly decoupled on March 31, re-coupling by April 4, indicating temporary dollar dislocation. The tariff news drove a 125% spike in the VIX index to around 52 in early April, amplifying network errors and confirming VIXY’s influential role. EMB’s dual role as both a driven and driver asset underscored emerging markets’ centrality, as tariffs are particularly disruptive to them.

By April 11, average connectivity dipped to 3.6, hinting at early fragmentation as tariff shocks altered asset relationships.

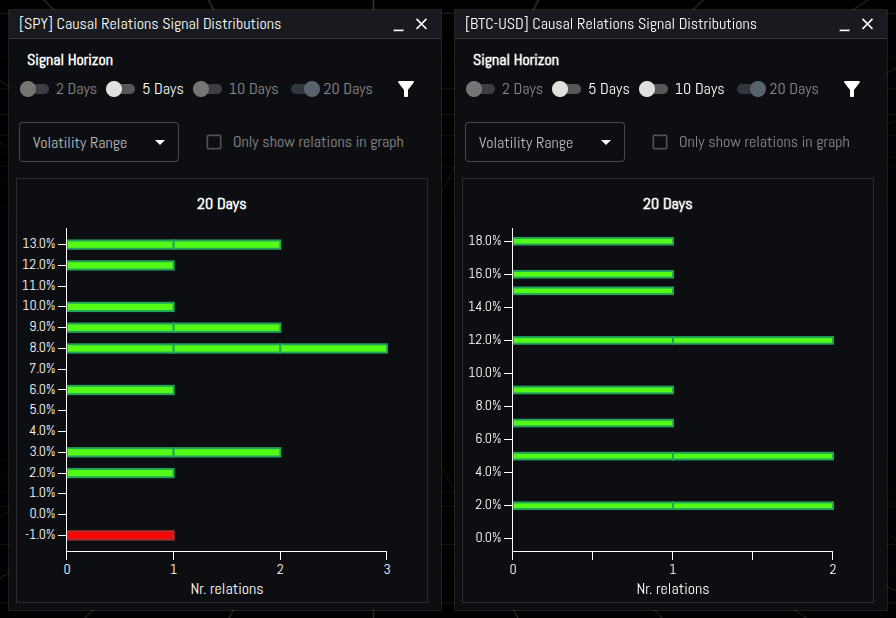

Trading opportunities emerged from forward-looking signals, with VIXY showing a significant drop across 5-, 10-, and 20-day horizons, while SPY and BTC-USD displayed strong 20-day upside potential. Gold’s 5-day outlook leaned downward, but the 20-day horizon suggested long opportunities.

For risk management, UUP’s decoupling and re-coupling signaled currency volatility, needing dynamic hedging strategies as it is behaving more like a risk asset.

Stage 3: Peak Volatility and Fragmentation (April 14–18)

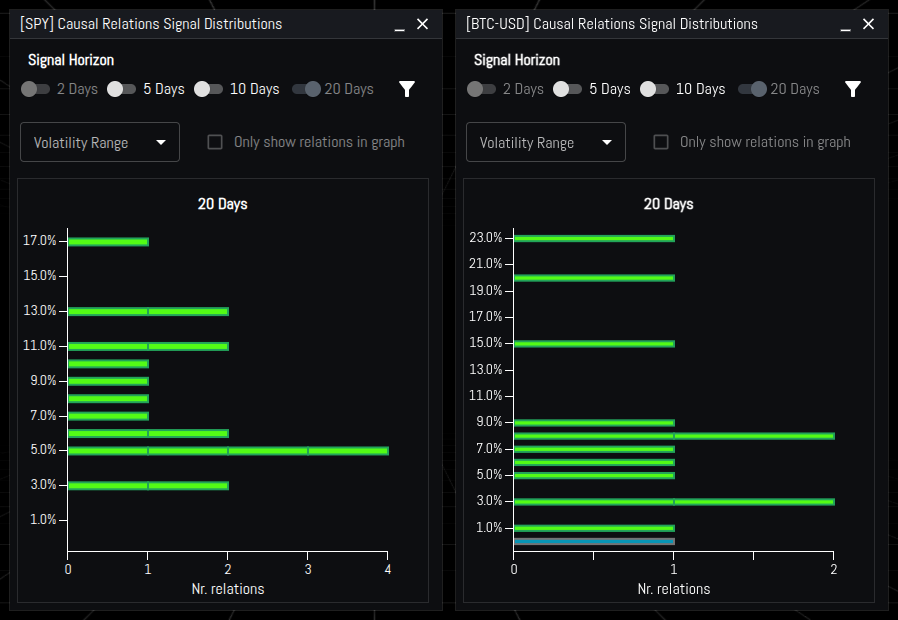

As volatility peaked, the network began to fragment, with average connectivity dropping from 3.5 to 2.5 and average relative error peaking at 5.4% before easing to 4.8%.

The Total Bond Market ETF (BND), BITW, and 10-year Treasuries replaced EMB, GLD, and VIXY as the most influenced assets, while SPY, GLD, VIXY, and EMB remained key influencers, though EMB lost its top driven status.

Low connectivity complicated predictions, signaling weakening inter-asset relationships. Despite this, EMB’s persistent driver role suggested emerging markets retained influence, likely due to adaptive trade strategies.

Trading opportunities included a continued decline in VIXY and sustained upside for SPY and BTC-USD over 20 days.

Risk management required broadening the network to identify external causal links, as low connectivity increased uncertainty (a critical indicator to consider in risk management).

Stage 4: Network Weakening (April 21–28)

The network weakened further, with average connectivity stabilizing at 2.5, average relative error ranging from 4–4.8%, and directional accuracy holding at around 66%. BND, the 7-10-year Treasury Bond ETF (IEF), and 10-year Treasuries dominated as driven assets, while VIXY became the primary driver, with EMB and SPY dropping from top influencer roles by April 21.

UUP decoupled again by April 21, followed by GLD, SPY, and QQQ by April 24, forming a separate sub-network. UUP re-coupled by April 28, and EMB regained driver status by April 29.

The dominance of bond-related assets pointed to a flight to safety, with VIXY driving volatility signals. The decoupling of GLD, SPY, and QQQ highlighted market segmentation, as equities and gold diverged from bonds and volatility. EMB’s return as a driver by April 29 suggested emerging markets’ influence persisted amid trade policy uncertainty.

Trading opportunities included continued 20-day upside for SPY and BTC-USD, while GLD’s 20-day forecast showed downward pressure with four dissenting signals pointing towards a small increase (1%).

Stage 5: Extreme Fragmentation (May 1–14)

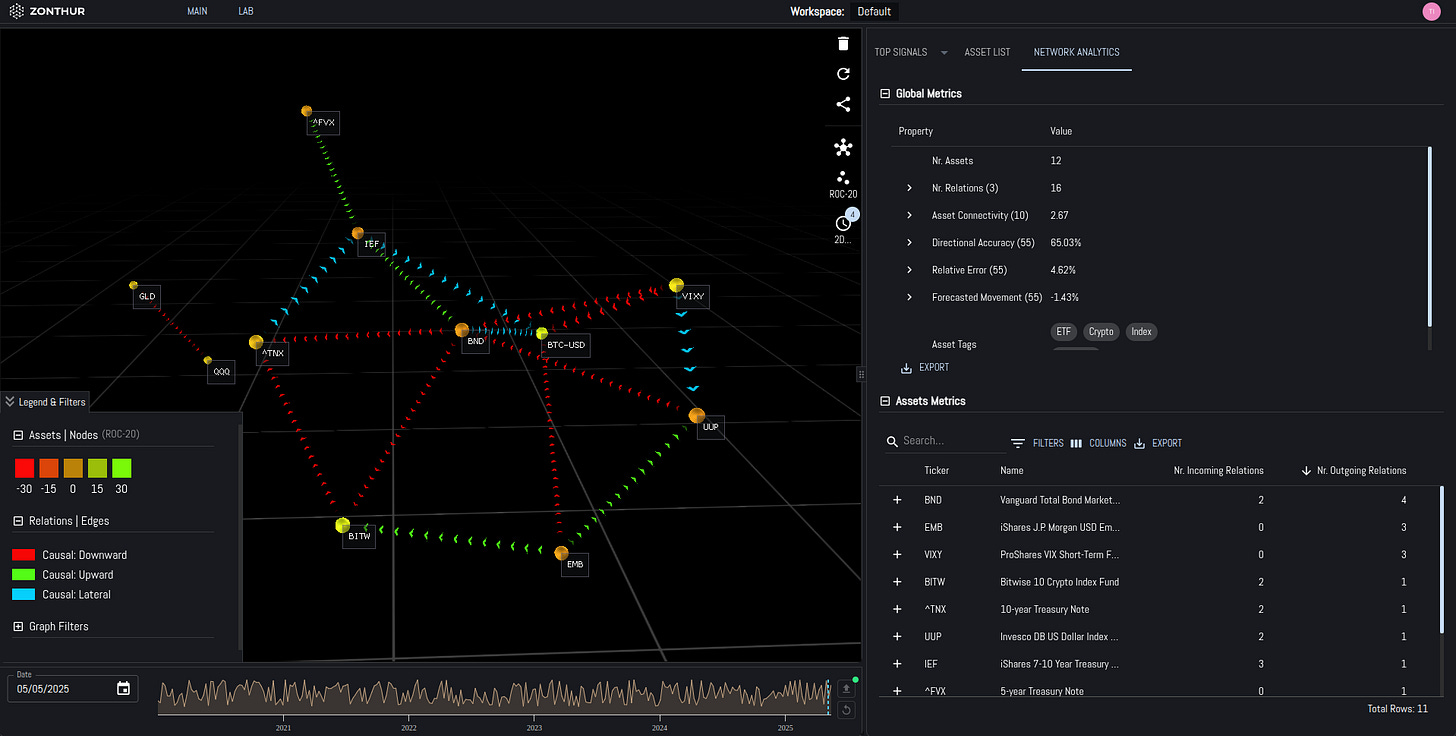

By early May, the network reached its weakest state, with average connectivity bottoming at 1.45 on May 8 and directional accuracy dropping to 59% on May 13. Average relative error fell from 4.8% to 4% but remained elevated.

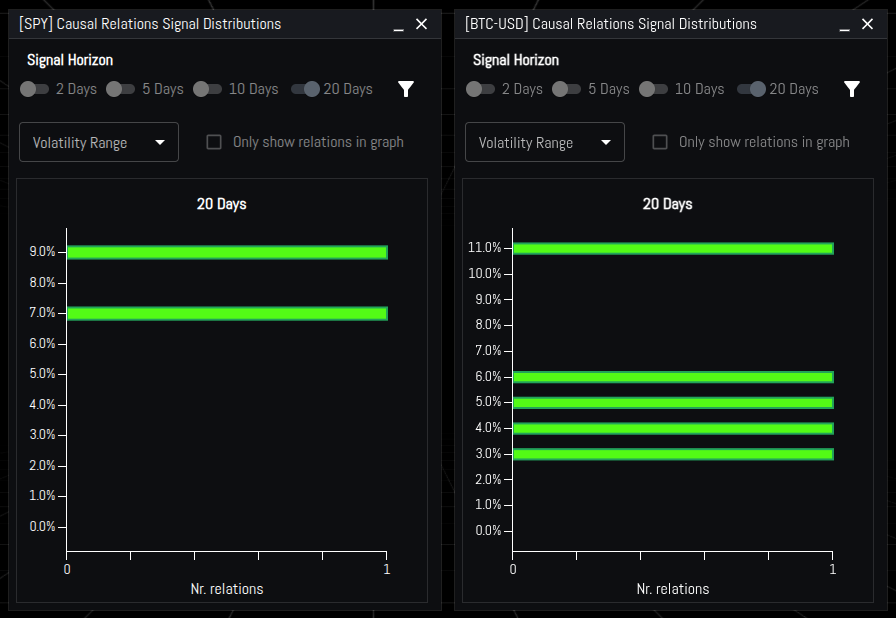

IEF and BTC-USD emerged as top driven assets, while EMB and BND were primary influencers. GLD, SPY, and QQQ remained decoupled, losing inter-connectivity.

The collapse in connectivity and accuracy reflected a breakdown in causal relationships, driven by tariff de-escalation on May 12 and the Federal Reserve’s decision to hold rates on May 1. Despite this, EMB’s role as a top driver highlighted its resilience, likely tied to emerging markets’ role in global supply chains and South-South trade growth.

BTC-USD’s emergence as a driven asset suggested growing crypto sensitivity to macro shifts, possibly as a hedge against tariff and monetary policy changes.

Risk management became critical, as low directional accuracy increased forecasting risks, requiring expanded network analysis to capture external drivers of asset price behavior.

Conclusion

Causal network analytics provide a vital edge in navigating volatile and uncertain periods - such as the current trade wars.

By tracking asset relationships - from EMB’s rising vulnerability to VIXY’s impact and the network’s eventual fragmentation - these models deliver insights for informed strategic and tactical decisions.

Portfolio managers can leverage these findings to refine trading strategies, optimize portfolio allocations, and strengthen risk frameworks as markets continue to evolve.

Disclaimer: The information provided in this content is for general informational purposes only and does not constitute investment, financial, legal, tax, or other professional advice. It should not be relied upon as such. Always consult with a qualified professional or advisor before making any investment or financial decisions.