Methodology

Understanding Causal Networks: A Simple Primer

What Are Causal Networks?

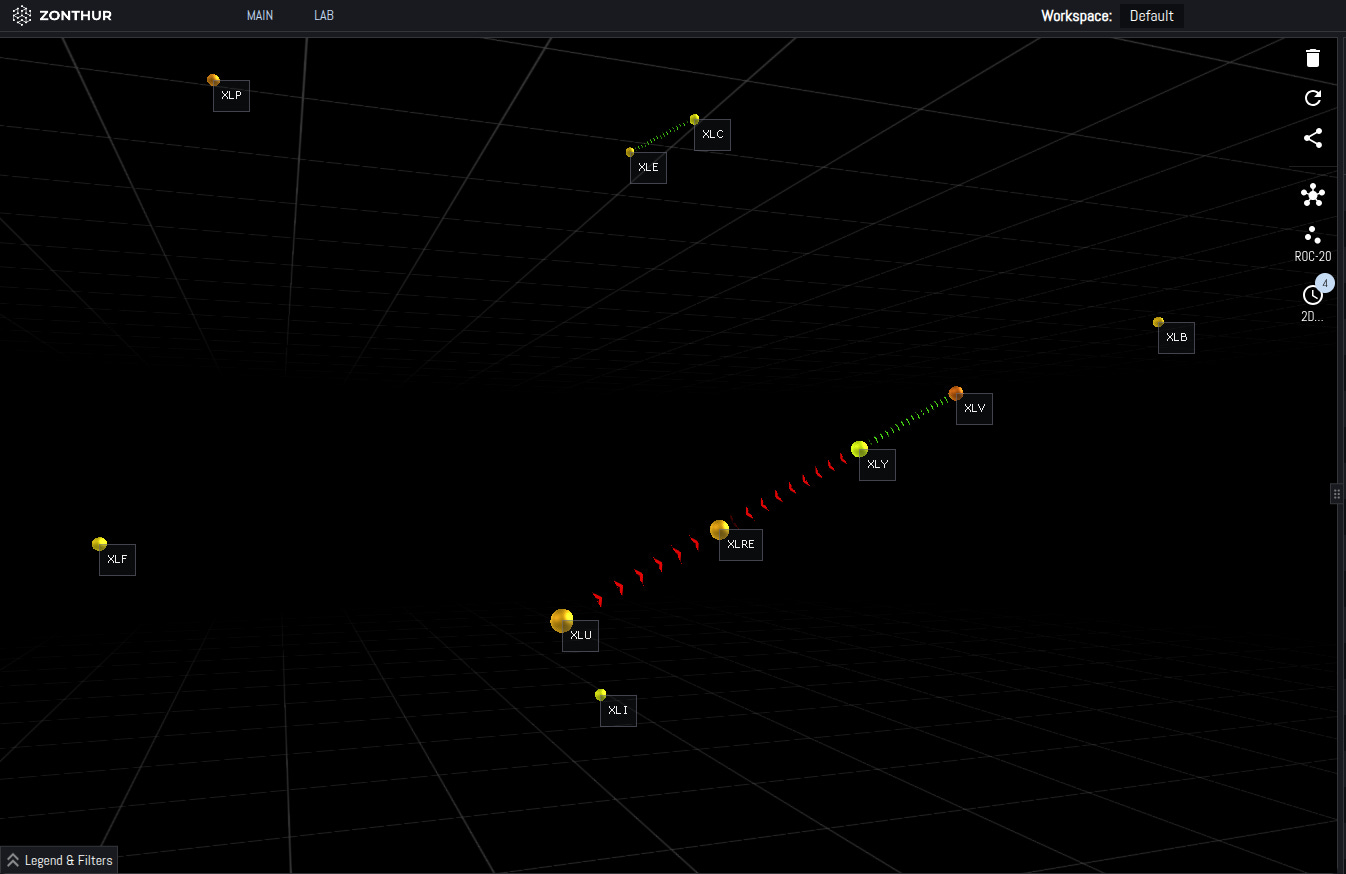

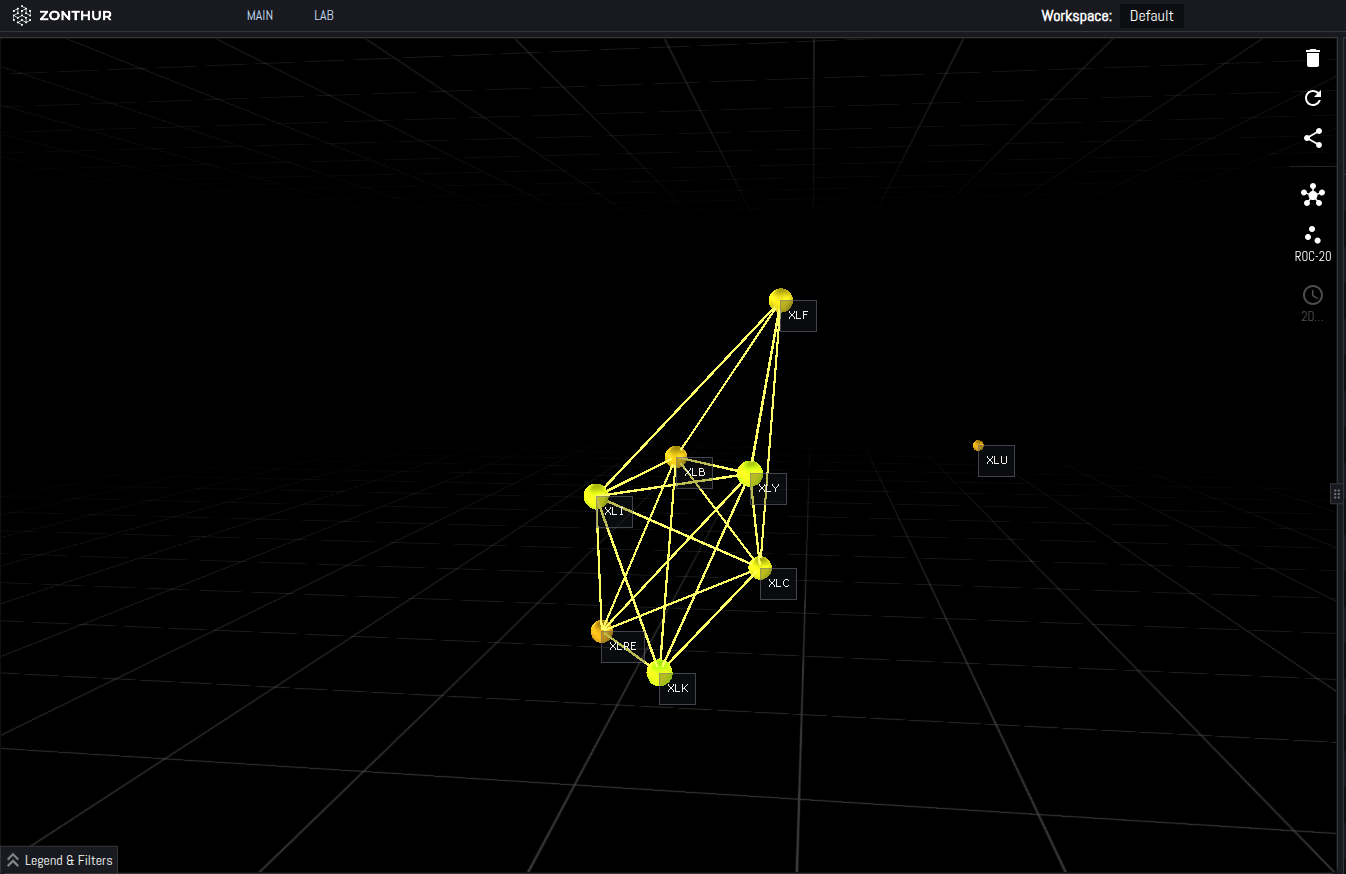

Causal networks map how assets (e.g., stocks, bonds, gold) directly influence each other’s price movements. Unlike traditional models, they identify cause-and-effect relationships, revealing which assets drive changes in others and how these dynamics evolve over time. At Zonthur, our causal network analytics use advanced algorithms to detect these directional relationships with high accuracy.

How Do They Differ from Correlation Networks?

Correlation networks show which assets move together, but they don’t clarify why or which asset is leading. For example, if gold and stocks rise together, correlation only notes the similarity, not whether one causes the other. Causal networks go further, pinpointing whether gold’s price shift drives stocks or vice versa, offering clearer insights for trading and risk management.

What Does It Mean for an Asset to Be Driven or to Drive?

Top Driven Assets (High In-Degree): These assets are influenced by many others in the network. For instance, if emerging market bonds (EMB) are driven by stocks, Treasuries, and volatility, their prices react strongly to changes in those assets. This signals vulnerability to external shocks but also potential opportunities for hedging.

Top Driver Assets (High Out-Degree): These assets influence many others. If stocks (SPY) drive bonds, gold, and crypto, their movements ripple across the network. Drivers are key for portfolio construction, as they shape broader market trends.

By focusing on causality, our networks provide actionable insights into asset relationships, helping asset managers navigate complex markets like the recent trade wars.